Selling structured settlement payments is not just a financial decision—it’s a life choice that can open doors to new opportunities, immediate liquidity, or a chance to restructure personal goals. Many people ask, how do I sell my structured settlement payments, but the process often feels overwhelming without the right guidance. In this article, I’ll walk you through everything you need to know: structured settlement rates, examples, cash-out options, and the real costs of selling. Whether you’re new to the concept or already considering a sale, this guide will provide a roadmap designed to help you make smart, confident decisions.

Need immediate cash for your structured settlement? Discover flexible cash-out solutions tailored for your situation. Whether it’s medical bills, investment opportunities, or personal projects, you deserve a financial plan that puts you in control.

Table of Contents

- Understanding Structured Settlement Payments

- Why People Choose to Sell Structured Settlements

- Structured Settlement Rates Explained

- Examples of Structured Settlements in Real Life

- Can You Cash Out a Structured Settlement?

- How Much Does It Cost to Sell a Structured Settlement?

- Steps to Sell Structured Settlement Payments

- Risks and Benefits of Selling

- Using a Sell Structured Settlement Calculator

- Final Thoughts and Action Steps

1. Understanding Structured Settlement Payments

Before diving into rates, costs, or the actual process of selling, it’s important to understand what structured settlement payments are and why they exist. These financial arrangements are typically awarded after a lawsuit settlement, where the recipient chooses to receive periodic payments instead of one lump sum. This provides stability, ensuring long-term financial security. However, as life evolves, these fixed payments may not always match the urgent needs of the recipient. That’s when selling structured settlement payments becomes an option worth exploring.

- Definition and Core Purpose: A structured settlement payment is designed to provide predictable, tax-advantaged income over time. For example, a personal injury victim might receive monthly payments for 20 years. While this ensures stability, it may limit flexibility when immediate funds are needed.

- How It Differs from Lump-Sum Settlements: Unlike receiving all the money upfront, structured settlements stretch the funds across years. This prevents reckless spending, but if an urgent need arises—like buying a home or covering education costs—selling becomes a reasonable solution.

- Legal Protections: Structured settlements are often backed by court approval and insurance annuities. This guarantees payments, but it also means selling requires legal oversight to ensure fairness.

- Connection to Long-Term Financial Planning: Many recipients use structured settlements as a core part of retirement or family planning. However, unexpected life events may demand faster access to cash, creating tension between long-term security and short-term liquidity.

- Why Knowledge Matters: Without understanding how structured settlements work, sellers risk undervaluing their payments. Knowing the basics is the first step toward making informed, confident decisions.

2. Why People Choose to Sell Structured Settlements

Life doesn’t always align with fixed payment schedules. While structured settlements are designed for stability, there are countless reasons why someone might want to sell. The decision often reflects personal needs, urgent obligations, or opportunities that require immediate access to capital. Exploring these motivations helps you see whether selling is a smart step for your own situation.

- Emergency Medical Expenses: One of the most common reasons people sell is to cover urgent healthcare costs. Imagine needing a life-saving surgery but being locked into small monthly payments—selling offers a path to funding critical treatment on time.

- Debt Consolidation: High-interest debt can quickly spiral out of control. By selling a portion of a structured settlement, recipients can pay off debts, reduce interest costs, and regain financial peace of mind.

- Educational Opportunities: Parents often sell structured settlements to finance college tuition or advanced studies for their children. Education is an investment, and immediate liquidity can make it possible to seize opportunities that might otherwise be lost.

- Business Ventures: Entrepreneurs sometimes use structured settlements as startup capital. Instead of waiting years for periodic payments, selling provides the lump sum needed to launch a business with growth potential.

- Home Ownership and Major Purchases: Buying a house, relocating, or even upgrading to reliable transportation are common motivators. Selling allows recipients to secure a better lifestyle faster than waiting on slow, incremental payments.

Thinking about selling your structured settlement? You don’t have to navigate this process alone. Our experts can help evaluate your payments, compare rates, and give you a fair, fast offer that meets your needs.

3. Structured Settlement Rates Explained

When it comes to selling structured settlements, one of the biggest questions is: how much will I actually get? The answer lies in structured settlement rates. These rates reflect the present value of your future payments, adjusted by market conditions, legal fees, and company policies. Understanding how rates work ensures that you won’t be caught off guard by lowball offers.

- Discount Rate Basics: Structured settlement companies calculate rates using a discount percentage. This means the future value of your payments is reduced to reflect their present-day worth. For example, $50,000 due over 10 years might only yield $30,000 today depending on the discount rate.

- Factors Affecting Rates: Interest rates, inflation, and even company competition play a role. A higher interest environment generally lowers your payout because companies calculate greater risk over time.

- Transparency Matters: Some buyers hide fees or apply unfairly high discount rates. Asking for a clear breakdown helps you see whether you’re getting a fair deal.

- Comparing Multiple Offers: Just like shopping for insurance, it’s wise to get quotes from different buyers. Even a 1–2% difference in rates can mean thousands of dollars more in your pocket.

- Legal Approval of Rates: Courts often review structured settlement sales to ensure the discount rate is reasonable. This legal safeguard protects sellers from predatory offers that could strip away too much value.

4. Examples of Structured Settlements in Real Life

Understanding structured settlements becomes easier when we explore real-world examples. These scenarios highlight how different individuals benefit from structured settlements and why some eventually choose to sell. By examining these cases, you can better evaluate whether selling your own structured settlement is the right path. Each example illustrates practical applications, the pros and cons of keeping versus selling, and the personal impact on financial stability.

- Personal Injury Case: Imagine a car accident survivor receiving $2,000 per month for 20 years. While this guarantees stability, unexpected medical bills can drain resources quickly. In this case, selling part of the settlement for a lump sum allows the recipient to cover treatments without financial stress.

- Workplace Accident: A construction worker injured on the job may be awarded structured payments over 15 years. But with rising inflation and urgent needs like home modifications, selling payments ensures immediate comfort and accessibility upgrades.

- Wrongful Death Settlement: Families receiving monthly payments after losing a loved one may find it difficult to cover funeral expenses or support dependents. A lump sum from selling can provide immediate relief and long-term financial planning options.

- Lottery Winnings: Some lottery payouts are structured similarly, with annual installments. Winners often choose to sell future payments to secure cash upfront for investments, travel, or debt payoff.

- Child Support and Education Funding: In certain settlements involving minors, funds are structured until the child reaches adulthood. Parents may later decide to sell portions of the settlement to finance early educational opportunities or medical needs.

5. Can You Cash Out a Structured Settlement?

A common question people ask is, can you cash out a structured settlement? The short answer is yes, but with legal and financial considerations. Structured settlements are designed for long-term stability, so cashing out requires court approval and typically involves selling to a specialized company. The process can be smooth if you know what to expect and prepare accordingly.

- Partial vs. Full Cash-Out: You don’t always have to sell the entire settlement. Many companies allow you to cash out just a portion, giving you flexibility while retaining future security.

- Legal Approval Process: Courts evaluate whether selling is in your best interest, especially in cases involving minors or vulnerable adults. This oversight ensures fairness and protects sellers from exploitation.

- Timeframe for Cashing Out: The process usually takes 30–90 days, depending on state laws and court schedules. Planning ahead is key if you need funds by a certain date.

- Market Impact on Cash-Out Value: Your payout depends heavily on structured settlement rates at the time of sale. Monitoring market trends helps you time the sale for maximum value.

- Choosing the Right Buyer: Not all buyers are equal. Reputable companies offer transparent rates, while others may impose hidden fees. Doing due diligence helps secure a fair deal.

Ready to explore cash-out options? With expert guidance, you can decide whether a partial or full sale is best for your goals. Our trusted partners provide fair, competitive offers designed to help you get the liquidity you need without unnecessary stress.

6. How Much Does It Cost to Sell a Structured Settlement?

Another important consideration is cost. Many people ask, how much does it cost to sell a structured settlement? While there isn’t a single flat fee, the true cost is reflected in the discount rate applied by buyers. This discount effectively reduces the total value of your future payments when converted into a lump sum today. Understanding these costs helps avoid unpleasant surprises.

- Discount Rate as the Primary Cost: If your structured settlement is worth $100,000 over 10 years, you might only receive $60,000–$70,000 today. That difference—30% to 40%—represents the cost of selling.

- Legal and Court Fees: Court proceedings may involve filing fees, attorney costs, or administrative expenses. Some buyers cover these, while others pass them to the seller. Always clarify upfront.

- Hidden Charges: Be cautious of companies adding “processing” or “expedite” fees that eat into your payout. Transparency is key in avoiding these hidden deductions.

- Opportunity Cost: Beyond immediate fees, consider the long-term impact of giving up future security. Selling too much could leave you financially vulnerable years down the road.

- Strategies to Minimize Costs: Comparing offers, negotiating terms, and seeking legal counsel can all help reduce overall costs and maximize your payout.

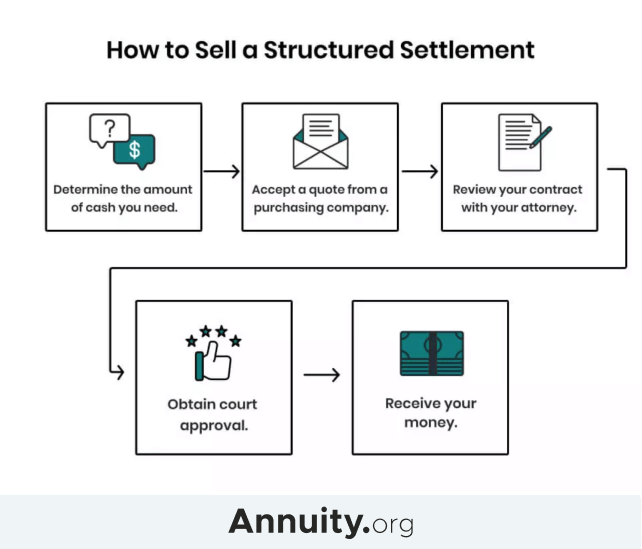

7. Steps to Sell Structured Settlement Payments

If you’ve decided to move forward, understanding the step-by-step process makes the journey smoother. While it may seem complicated, the steps to sell structured settlement payments are fairly straightforward when broken down. Each step is crucial to ensuring you secure the best deal while staying compliant with legal requirements.

- Evaluate Your Needs: Start by asking yourself why you want to sell. Is it for debt relief, medical expenses, or investment opportunities? Being clear about your purpose helps you decide how much to sell and what structure works best.

- Request Multiple Quotes: Approach several companies and compare offers. Even small differences in discount rates can add up to thousands of dollars in your final payout.

- Seek Legal Advice: An attorney specializing in structured settlements can review contracts, explain hidden terms, and ensure your interests are protected.

- Court Approval: Once you’ve chosen a buyer, the sale must be approved by a judge. The court ensures the deal is fair and in your best interest, especially if you are vulnerable or selling a large portion.

- Receive Your Funds: After court approval, the buyer transfers your lump sum. Depending on the arrangement, funds are typically available within a few weeks.

8. Risks and Benefits of Selling

Every financial decision carries trade-offs, and selling structured settlement payments is no exception. While it can provide immediate liquidity and financial flexibility, it may also reduce your long-term security. Understanding both the risks and benefits ensures that your choice is based on clarity, not impulse. Let’s examine the key factors that make selling either a smart solution or a risky move depending on your circumstances.

- Benefit: Immediate Access to Cash: Selling provides quick liquidity for urgent needs such as medical care, education, or home purchases. For example, instead of waiting 15 years for payments, you could access a lump sum today to cover high-priority expenses.

- Benefit: Debt Elimination: Using settlement proceeds to pay off credit cards or loans at high interest rates can save thousands of dollars in future interest, giving you greater financial peace of mind.

- Risk: Reduced Long-Term Security: By selling, you give up guaranteed income in the future. If not managed wisely, the lump sum may be spent too quickly, leaving you without a financial safety net later in life.

- Risk: Predatory Offers: Not all buyers operate ethically. Some impose unfair discount rates or hidden fees, leaving sellers with far less than their payments are worth. This is why due diligence is critical.

- Balancing the Decision: The best approach is often partial selling—cashing out only what you need now while keeping the rest for future stability. This way, you enjoy both liquidity and long-term security.

9. Using a Sell Structured Settlement Calculator

One tool that simplifies decision-making is the sell structured settlement calculator. This tool estimates how much your future payments are worth today, factoring in discount rates, payment schedules, and market conditions. While calculators provide a helpful baseline, they should never replace professional evaluation.

- Understanding the Estimate: A calculator takes the number of payments left, their frequency, and the current discount rate to generate an approximate lump-sum value. For example, $1,000 monthly over 10 years might calculate to $85,000 today.

- Limitations of Calculators: These tools often provide a general estimate without accounting for legal fees or unique personal circumstances. The actual payout may be higher or lower depending on negotiations.

- Benefits of Early Use: Using a calculator before contacting buyers gives you a benchmark. You’ll know if an offer is within a fair range or if a company is undervaluing your settlement.

- Comparison Shopping: By testing different scenarios in the calculator, such as selling part versus all of your settlement, you can visualize the financial impact of each choice before committing.

- Combining with Expert Advice: The calculator is best used alongside financial and legal advice. Experts can refine the estimate and guide you through hidden complexities.

10. Final Thoughts and Action Steps

Selling structured settlement payments is a significant financial decision, but with knowledge, preparation, and the right partners, it can be a powerful tool to achieve your goals. Throughout this guide, we’ve explored structured settlement rates, examples, cash-out options, and the real costs of selling. You now understand not only can you sell a structured settlement, but also how to maximize your return while protecting your long-term interests. The final step is taking action with confidence.

- Clarify Your Goals: Ask yourself why you want to sell and whether the decision aligns with your broader financial objectives. Is it for debt relief, investment, or emergency needs?

- Do Your Research: Explore multiple buyers, compare structured settlement rates, and avoid offers that seem too good to be true. Reliable companies will always be transparent about costs.

- Seek Legal Guidance: Even if it feels like an extra step, having a lawyer review your sale protects you from predatory contracts and ensures compliance with the law.

- Consider Partial Selling: Selling only part of your settlement keeps future income flowing while giving you immediate cash for your priorities.

- Take Action Today: Delaying the process can mean missing opportunities or facing worsening financial strain. With the right approach, you can turn your settlement into a strategic asset.

Your financial future starts with one decision. Don’t leave money on the table or settle for less than you deserve. Explore fair offers, transparent rates, and expert guidance today. The sooner you act, the sooner you can unlock the cash you need to achieve your goals.

By now, you should feel empowered with the knowledge to make an informed decision about selling structured settlement payments. Remember, the right move isn’t always selling everything—it’s about finding the balance between immediate needs and long-term security. If you’re ready to take the next step, use our resources, test a sell structured settlement payment calculator, and connect with trusted experts who can guide you through the process from start to finish.